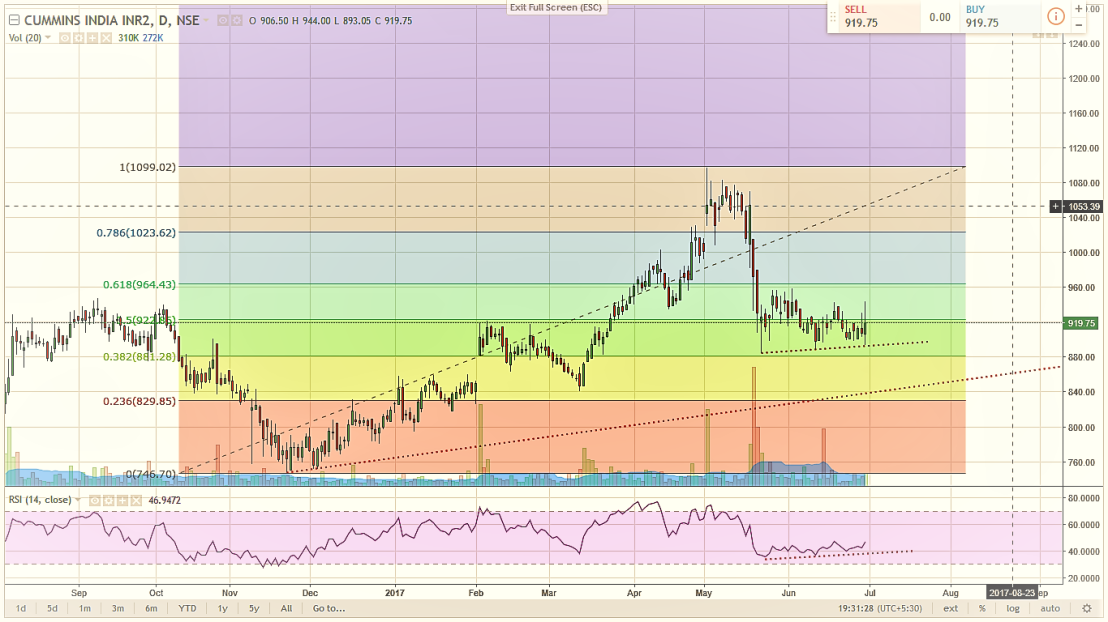

After result day Cummings India failed to reach market exception price sharply corrected from 1070 to 885 levels, But Still quarterly numbers are pretty well & ended up with 159cr profits. Technically now price has failed to break 38 percent retracement level 881 and Managed trade near above 50 percent retracement 992. Currently closed @ 919 -1.32% levels trades can buy in the range of 915 -900 levels with stoploss below 880 levels.

Happy Trading

For personalized trading solutions

jnaneshdshetty@gmail.com

Risk Disclaimer

ALL INFORMATION GIVEN HERE IS LARGELY BASED ON TECHNICAL ANALYSIS WHICH IS HIGHLY DYNAMIC IN NATURE AND RELEVANT ONLY AT A PARTICULAR POINT OF TIME. USERS ARE ADVISED TO PURSUE THESE RECOMMENDATIONS ONLY AT THEIR OWN RISK AND FIRST CONSULT THEIR PERSONAL INVESTMENT ADVISOR WHEN MAKING INVESTMENT DECISIONS. WE ARE NOT LIABLE AND WE DON’T TAKE ANY RESPONSIBILITY FOR ANY LOSS BY TRADING/INVESTING ON OUR RECOMMENDATIONS.THESE CHARTS ARE POSTED FOR EDUCATIONAL

PURPOSE ONLY.